Net Lease

Industrial

Multifamily

Office

Retail

Hospitality

Customized and creative financing solutions for every deal and client.

Delivering fresh insight and real time market information to clients.

Long standing relationships with banks, credit unions, conduit lenders, agency lenders, lifecompanies, debt funds, and private lenders.

We work for you. We do not accept compensation from capital sources.

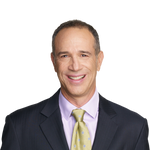

Brad Kraus is an executive vice president at Kidder Mathews, specializing in debt & equity capital advisory. A veteran of the commercial real estate finance industry, Brad has 25 years of multifaceted commercial real estate investment and advisory experience. Nine years in the trenches underwriting, structuring and closing CRE loans for Ackman-Ziff & Meridian Capital in New York City laid the foundation for Brad’s successful career as a capital advisor.

Brad has extensive experience structuring deals across the capital stack on all asset types, including value-add and stabilized projects, mezzanine and preferred equity financings, and ground-up development. His experience, which reaches back prior to the Great Financial Crisis and spans up and down the capital stack, has been critical to successfully advising his clients throughout commercial real estate cycles. His lending experience runs deep with $5B+ worth of capitalizations nationwide with long trusted relationships at regional banks, credit unions, life co.’s, CMBS, FNMA/Freddie, debt funds, and private money.

Brad holds a master of science in real estate finance from New York University and a bachelor of arts in history from Colgate University. As a founding member of CFBN, a collective of 67 CRE capital professionals representing 25 markets coast to coast, Brad’s focus has remained on delivering timely market intelligence and surety of execution to both clients and investment sales agents. A frequent guest presenter at conferences and recognized award winner and pundit within the industry, Brad’s favored pastime is inking a monthly industry commentary that has been picked up by periodicals such as The New York Observer & Globe Street.

Brad is married to his wonderful wife Sharon, and together they reside on the West Side of Los Angeles with their young son Theo, and whippet, Abbey Road. Brad’s passions outside of work and family involve adrenaline-inducing activities such as snowboarding and mountain biking.

EDUCATION

MS in real estate finance, New York University

BA in history, Colgate University

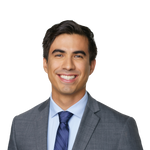

Jorge Gomez is a debt & equity analyst with Kraus Team. He is a seasoned commercial real estate placer/closer, with over a decade of experience underwriting, sourcing, and negotiating financing with lenders nationwide. Having facilitated over 200 transactions throughout his career, Jorge’s in-depth knowledge of all asset types and adroit processing are critical components of the Kraus Team’s success. Focused on selecting financing that aligns with client objectives, Jorge’s lender knowledge base spans banks, credit unions, CMBS, life co.’s, debt funds, and private money.

Prior to transitioning into capital advisory in 2015, Jorge worked in CRE originations and portfolio management with real estate crowdfunding lending firm, Patch of Land. His career path out of UCLA began as analyst & asset manager with Strategic Realty Capital, a real estate private equity firm.

Jorge holds a political science degree from UCLA, and completed the Ross Program in Real Estate Development at USC. He participates in the real estate alumni groups of both universities and is a member of CFBN, a nationwide collective of commercial real estate finance firms.

EDUCATION

BA in political science, University of California, Los Angeles

team services

SURETY OF EXECUTION — OUR HANDS-ON APPROACH

personalized analysis & advisory

Comprehensive review and underwriting coupled with market insight and goal setting for clients.

01

bullseye marketing

Preparation of the financing memorandum with custom narrative supported by best in class rental and sales comps. In-house design adds the final touches to make the Kraus Team's book stand out in the crowd as we strategically target 30+ lenders on each assignment.

02

the bidding war

Tight control of the lender selection process with continual negotiations on all competing quotes insuring the best rate and terms. Preparation and updating of capital matrix for clear concise evaluation of top lender prospects.

03

capital source selection

Informed discussions & decision making for final lender choice. Comprehensive review and amendment of the loan application to commence the process.

04

white glove loan processing

Your dedicated analyst/processor does the arduous application work: prefilling forms, supervising 3rd party reports, and organizing due diligence for an easy borrower ride to funding.

05

closing with a smile & handshake

Reviewing all loan docs, ensuring all business terms are correct, coordinating with escrow/title and lender for a smooth funding and recording. Closing binder with all docs & reports is distributed along with vault access to client’s personal data.

06

kidder mathews overview

the edge in your market

For over 55 years, our clients have gotten the best of both worlds — independent counsel from trusted experts, working as part of the largest privately held commercial real estate firm in the Western U.S. Today Kidder Mathews has over 900 real estate professionals and staff in 19 offices in Washington, Oregon, California, Nevada, and Arizona.

The Kraus Team provides national reach, consistently closing transactions throughoutall 48 contiguous states and Hawaii.

KM SERVICES

Debt & Equity Finance

Commercial Brokerage

Valuation Advisory

Asset Services

Commercial Brokerage

500+

NO. OF Brokers

$9B

average annual transaction volume

Asset Services

54M SF

management portfolio size

800+

assets under

management

Valuation Advisory

2,700

average annual assignments

42/23

total no. of

appraisers/mai's

AWARD-WINNING SERVICES

210+

Times Ranked as a Largest CRE Firm

100+

Awards for Best Places to Work

10+

National Awards for CRE Marketing

6X

Inc. 5000 Fastest Growing Private Companies